What is a Mortgage Broker?

A mortgage broker is an intermediary individual or company that liaises between the consumer borrower and the mortgage lender (usually a bank). Mortgage brokers work directly with both the borrower and the lender with the aim of securing funds towards the purchase of a new home, or in the refinancing of an existing mortgage loan.

So, what is a mortgage broker:

- A mortgage broker acts as an intermediary between the mortgage borrower and lender

- A mortgage broker can provide guidance in securing a mortgage loan

- A mortgage broker can help you find the best home loan rates

- The average annual salary of a mortgage broker in Australia is $55,600

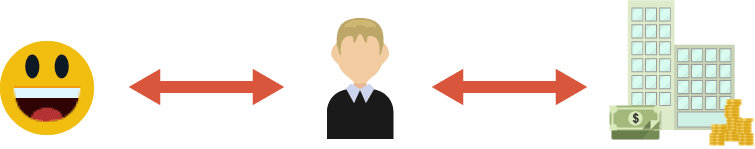

In the simple diagram above, the mortgage broker serves as the middleman between two important players in the mortgage transaction. The lender is on the wholesale side and the borrower is on the retail side.

A Mortgage Broker Can Guide You to Securing a Mortgage Loan

Once you agree to work a mortgage broker, he or she will guide you from start to finish. The broker will gather important information and relevant documentation like proof of income, employment documents, credit reports and other items that might be required by the lender to evaluate your eligibility to secure financing.

Once the mortgage broker has this information he or she can then figure out your best options for finance, such as setting a suitable loan amount, loan-to-value ratio, and also the type of loan best suited to your situation.

Of course, as a borrower, you have final say on the terms of the loan while the mortgage broker is only there to guide you. Once you iron out all the details, the broker will then forward your application to potential lenders. For the duration of the loan process, the mortgage broker should keep in touch with you and your lender, with the end goal being securing the loan.

Remember, when you work with a broker, you are not directly working with the lender. All communications go through the mortgage broker so you probably won’t be allowed to follow up your application directly with the lender.

A Mortgage Broker Can Help You Find the Best Rates

After taking care of all the paperwork, your mortgage broker will work with you to find the best available Australian rates. This the main benefit in working with mortgage brokers. They are experienced in shopping with different banks and lenders to find the best rate for you.

If you choose to work directly with a retail bank, the loan officer may only provide you with programs and rates from their bank only. If you need to look for other rates, you have to do it yourself or hire a broker to do it for you.

Take note that there are numerous mortgage lenders available today in Australia, and very few of them are willing to work without a broker. More options are the ideal situation so make sure you ask for multiple quotes from different lenders.

What is the average mortgage broker salary?

The average median annual salary of a mortgage broker in Australia is about $55,278. Mortgage brokers also make money through broker fees and commissions. You can choose if you want to pay this via the fees or through a higher interest rate on your loan. Be sure to ask your broker to discuss the payment options before you proceed with your application.

Mortgage broker fees can vary greatly. Hence, you should ensure that you complete due diligence before you agree to work with a mortgage broker. Always ask for the full list of fees and charges before you apply.

Absolutely Right, A Mortgage broker is the one who does all the investigation for the Borrowers to find the best deal for them. If You are Looking for a Mortgage Broker in Melbourne, Clark Finance Group is the Best Choice for you. They give transparent advice to the customer and provide the full necessary information with proper guidance for applying for a house loan or other financial service.