Over the last few years, the Australian Prudential Regulation Authority (APRA) has been trying to cool off the housing market to prevent investors from over-committing themselves with debt. Because of that, and rising interest rates for property investors to reflect the growing risks of these borrowers, there has been significant growth of Google searches about:

Property investment

- Investment loans

- Refinance

- Financial services

- Investment loan advice

- Investment mortgage

The reason behind APRA’s changes

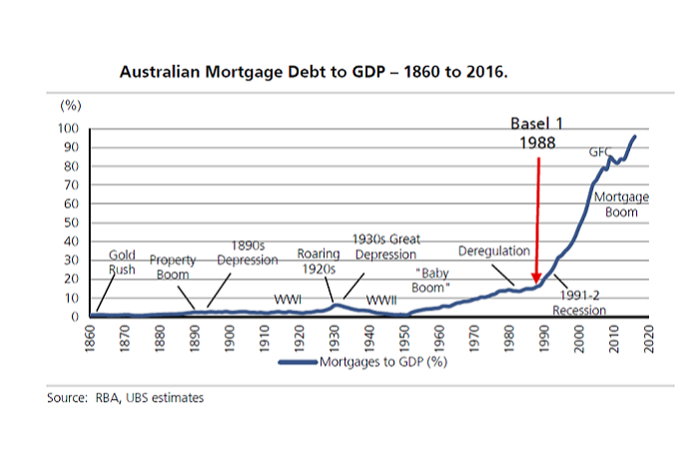

Historically, Australia has been enjoying a period of record low-interest rate, which has led to a surge in investment in the property market. However, learning from the Global Financial Crisis (GFC) of 2008, which was heavily influenced by bad debts, mismanaged mortgages and lending practice, APRA has driven recent new changes in the Australian lending practice and assessment.

As the graph shows, and based on the GFC experience, these changes were not a knee-jerk reaction. After several years of assessment and observation of the property investment market, and as an off cooling the ever-increasing sky rocking property price, new lending criteria started being implemented by banks and lenders to investment mortgage applicants.

This new model demanded different requirements for the banks such as:

- Have higher cash balance to their mortgage loan books.

- Increase the interest rate assessment used for mortgage serviceability.

- Use less of the (optional) rent as a determining factor in passing /failing a mortgage application.

After realising that the 33% of investment loans are considered high risk, APRA decided to implement a few variations to try to make life comfortable for over-extended borrowers.

These new standards started in late 2014 and have been sharpened lately, with the final green light to the banks, allowing them to re-price investor loan books. In this way they can cool investment loans and strengthen their balance sheets.

Investment loans searches increasing in the online market

Investors are now shopping around more, possibly looking at an alternative to the big four banks for means of funding their investment.

There has been an incredible increase in monthly search traffic for investment loans since December 2015.

According to our analysis of Google trends, in just over a year, this has increased 52 percent. Or put another way, there are now an extra 36.000 searches for keywords related to investment loan occurring each month – a substantial growth in search volume that is impossible to ignore.

This is a massive new trend that shows property investors are searching for help with their loans and mortgages, proving that there’s a big market online for investment loans.

It seems the APRA changes are really starting to bite out there in the market. Investors are turning to the online channel for a solution. This presents a huge opportunity for mortgage brokers.

Google searches are a palpable and valuable way to prove people’s curiosities and reactions these days; businesses should keep them in mind as the powerful tool they are.